About Us

Fraser Black, FoUnDEr oF FRASER FiNANCE.

Why Work With Us?

Because you’re busy. Because finance shouldn’t be complicated. And because we treat your business like it’s our own.

At Fraser Finance Solutions, we don’t believe in box-ticking or copy-paste lending. We take the time to understand what your business needs and match you with lenders who actually get it. With access to over 40 funders – from high-street banks to niche specialists – we secure competitive rates, fast decisions, and flexible terms tailored to you.

OUR PROCESS

Here’s a quick breakdown of how I get your finance sorted:

1.

We have a chat about your business and what you’re looking to fund Whether it’s a loan or an asset, I’ll ask the right questions to understand your business and build a proper story for the underwriter.

2.

I find the right lender (or lenders) for you I work with over 40 funders – I’ll focus on the ones who understand your line of work and get a quote that suits your business.

3.

I handle the proposal and paperwork I’ll fill in the forms, gather the info needed and send it all over.

4.

Getting an approval can take anywhere from 2 hours to 2 days depending on the lender. Once we get approval we contact the supplier to get the invoice ready to complete the finance docs.

5.

You sign the finance documents Either in person or online, whichever works best for you. Once signed, I send it for payout. Like before, this can be quick or take a day or two depending on the lender.

6.

Payout lands, job done The supplier gets paid, the deposit’s taken, and you’re sorted.

Supporting Subheading

Our Services

We offer a wide range of commercial finance options, including but not limited to.

HARD ASSET FinANCE

Funding for vehicles, plant, machinery and more – flexible and tailored to your business.

Soft Asset Finance

Finance for tech, office gear, salon or gym equipment – essential kit sorted

Invoice Finance

Free up cash tied in unpaid invoices and keep your cash flow steady.

<br

VAT & Corporation Tax Loans

Spread the cost of tax bills over time and protect your working capital.

Commercial Loans

Flexible funding for growth, investment or day-to-day needs – structured around you.

Commercial Mortgages

Buy or invest in property with competitive terms and expert support from start to finish.

Our Funding Partners

We work with over 40 trusted lenders – all handpicked to give you the best rates and fastest decisions.

Testimonials

EXCELLENTrecommendsTrustindex verifies that the original source of the review is Facebook. Fraser Financial Solutions done some quoting for me and made the process for agricultural equipment fast, clear, and hassle-free. They understood the needs of business and offered tailored financing options with no hidden costs. Great service, honest advice, and quick turnaround—highly recommended for anyone in the ag industry or any business needing finance for expansion.recommendsTrustindex verifies that the original source of the review is Facebook. Fraser was amazing in securing and organising commercial asset finance for my businesses, it was a smooth process from start to finish. Would 100% recommend Fraser!recommendsTrustindex verifies that the original source of the review is Facebook. Amazing service from start to finish so easy to deal with, I can highly recommend Fraser and will definitely use his services again ⭐️⭐️⭐️⭐️⭐️recommendsTrustindex verifies that the original source of the review is Facebook. Fantastic support from start to finish making navigating the end product super easy for us. Communication top rated all the way. Couldn't recommend more and will definitely use Fraser again. Steph and Keith McDougallrecommendsTrustindex verifies that the original source of the review is Facebook. ⭐️⭐️⭐️⭐️⭐️ I couldn’t recommend Fraser highly enough! From start to finish, the finance process for my new pick-up was the smoothest and most stress-free experience I’ve ever had with a credit application. 🛻💼 Fraser kept in regular contact throughout, keeping me updated at every stage and making sure I was always in the loop. When it came time to sign the paperwork, he even came out to my workplace so I didn’t lose any time from my day — now that’s service! 👏🏼🙌🏼 Top-class experience and genuinely 5-star service. Highly recommend to anyone looking for finance done right ✅recommendsTrustindex verifies that the original source of the review is Facebook. amazing service would recommend fraser to anyone rather than letting the company doing the sale arrange finance.recommendsTrustindex verifies that the original source of the review is Facebook. First class service from Fraser. After an initial call to go over what I wanted within 24 hours my company was approved for asset finance for a van for one of my staff members. I’d be happy to recommend Fraser to anyone and will definitely be using him again when I add another vehicle to the fleet.

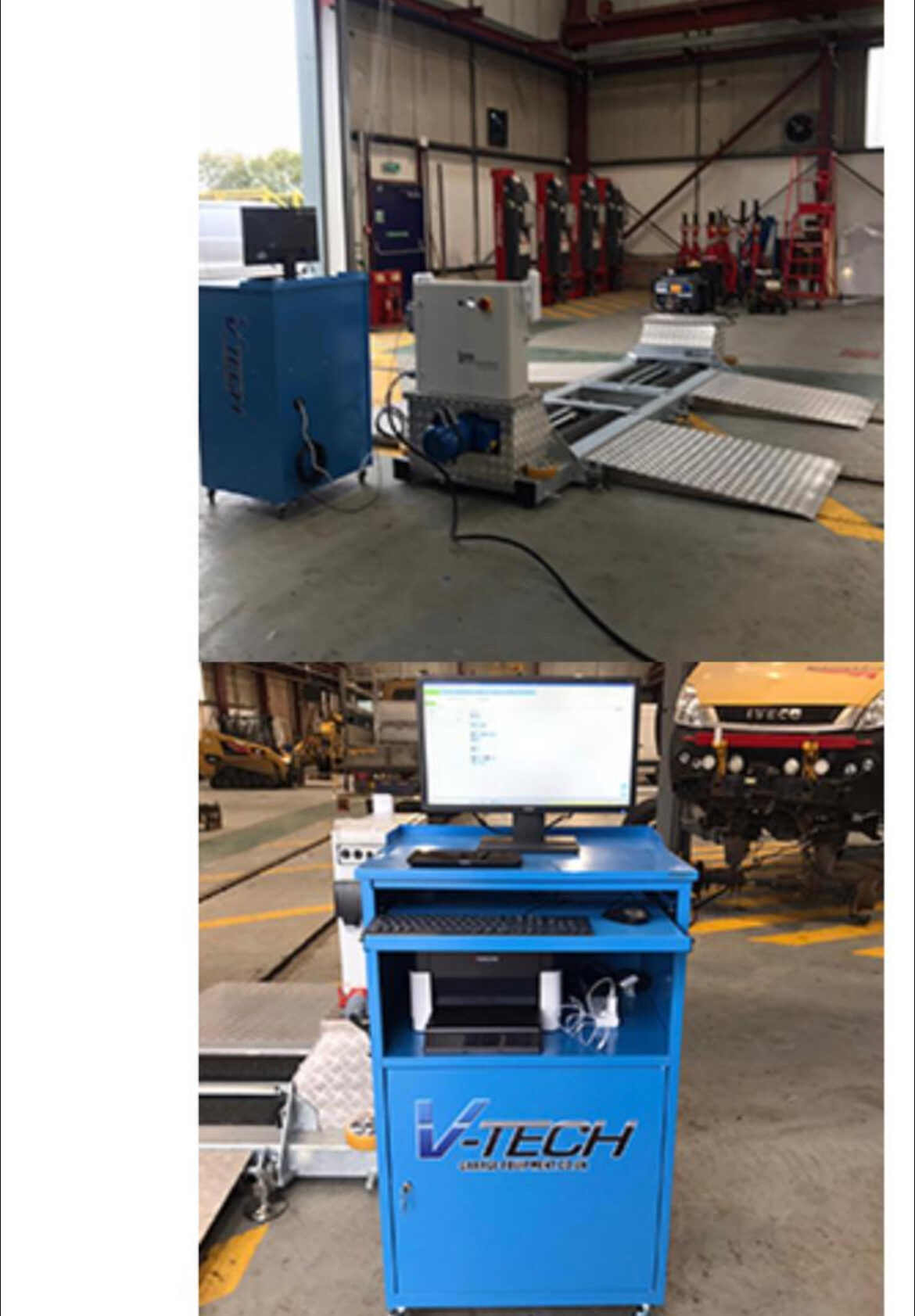

previous assets financed

Frequently asked questions

we're here to help.

Unlike a bank, my phone is always on. (Just don’t tell my wife…) If you need me, I’m here.

I’m good, but I’m not David Blaine. That said, I’ve helped plenty of businesses in tricky situations – and I’ll always be honest about what’s possible.

Yes – everything can be done digitally if that suits you. I do make a real effort to meet every client in person, but I know it’s not always possible (or convenient).

Absolutely. I also work with Van Broker Scotland, so I’ve got you covered on sourcing, financing, and even delivering your next van

Because no two businesses are the same. Working with over 40 lenders means I can find the right deal for your specific needs – whether it’s a big-name bank or a niche lender who understands your sector.